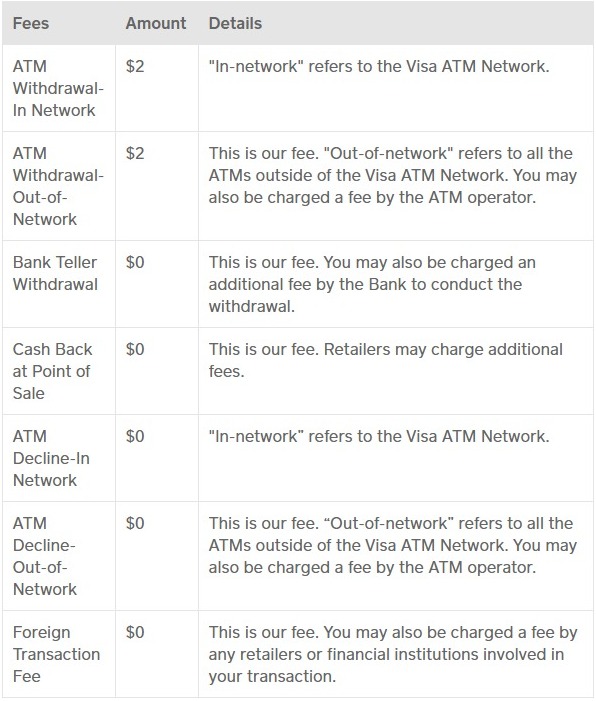

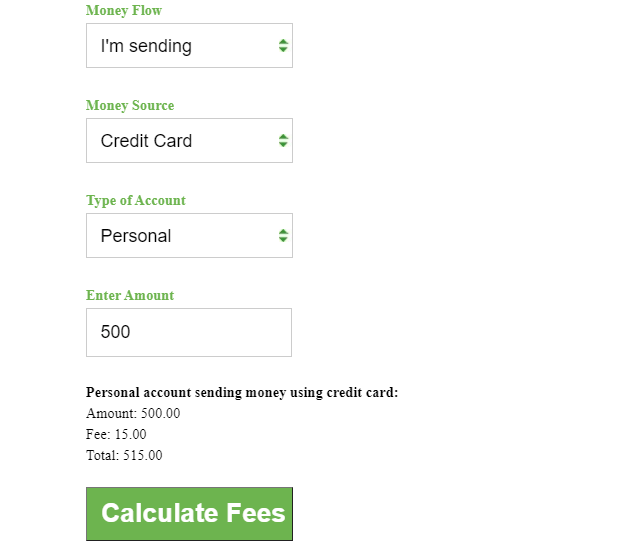

This doesn’t include the additional fee you’ll likely be charged by the atm itself for making a withdrawal with a card from a. This cash app fee calculator helps you calculate all the fees related to personal and business transactions using the cash app. Web these fees are: Let's explore the different types of transactions and associated fees: Web our cash app fee calculator tool can assist you in estimating the fees for your transactions based on our research of the official cash app fees.

Cash app offers a range of services, each with its own fee structure. Direct debit, wire transfer, debit card, credit card & apple pay. Web estimate cash app fees instantly. There is no minimum requirement to open a brokerage account with cash app investing. Let's explore the different types of transactions and associated fees:

Pro rata + an additional fee of up to $3. Web unverified accounts can only receive $1000 per month and send $250 per month. Web cash app charges a small $1 fee to consumers who add paper money to their accounts via a participating retailer. This fee ensures that users. Cash app has quickly become one of the most popular platforms for microtransactions.

Web cash app offers standard transfers to your bank account and instant transfers to your linked debit card. Direct debit, wire transfer, debit card, credit card & apple pay. Cash app offers a range of services, each with its own fee structure. Cash app has quickly become one of the most popular platforms for microtransactions. Please consult with your administrator. Cash app investing accounts are free to open, require no minimum balance to maintain, and charge no commission fees. Web this cash app fee calculator works out your fees when sending or receiving money via cash app. This doesn’t include the additional fee you’ll likely be charged by the atm itself for making a withdrawal with a card from a. Does cash app charge fees? Adding cash via direct deposit or linked bank account should not result in a fee. See how much you could be charged if you use cash app with a credit card, to invest, to trade bitcoins, and more. To verify the account, you hold with cash app, you’ll need to submit your social security number,. Web cash app charges a small $1 fee to consumers who add paper money to their accounts via a participating retailer. If you are sending money via a credit card linked to your cash app, a 3% fee will be added to the total. Web these fees are:

Web Cash App Investing Fees.

Cash app has quickly become one of the most popular platforms for microtransactions. We earn a commission from partner links on forbes advisor. Calculate fees of instant deposits. It makes splitting bills or sending other.

Web Estimate Cash App Fees Instantly.

Pro rata + an additional fee of up to $2. Cash app offers a range of services, each with its own fee structure. Web while there is no fee for standard transfers, if users opt for an instant transfer, a fee of 1.5% of the transaction amount is levied. However, if you have a cash app business account,.

Web These Fees Are:

Web how much are cash app fees? There is no minimum requirement to open a brokerage account with cash app investing. If you are sending money via a credit card linked to your cash app, a 3% fee will be added to the total. What are cash app's fees for.

Web Edgar Cervantes / Android Authority.

Web cash app charges a small $1 fee to consumers who add paper money to their accounts via a participating retailer. Direct debit, wire transfer, debit card, credit card & apple pay. Calculate cash app fees effortlessly with our online calculator. Please consult with your administrator.

.jpg)