Web learning how to read a footprint® chart. It’s about training your eyes what to look for, and trai. Web footprint charts provide volume information to candlestick charts. Web in this article, we will delve into the details of what we might call footprint trading, including the interpretation of footprint charts, identifying trading opportunities,. Displays the net difference at each price between volume initiated by buyers and volume initiated by sellers.

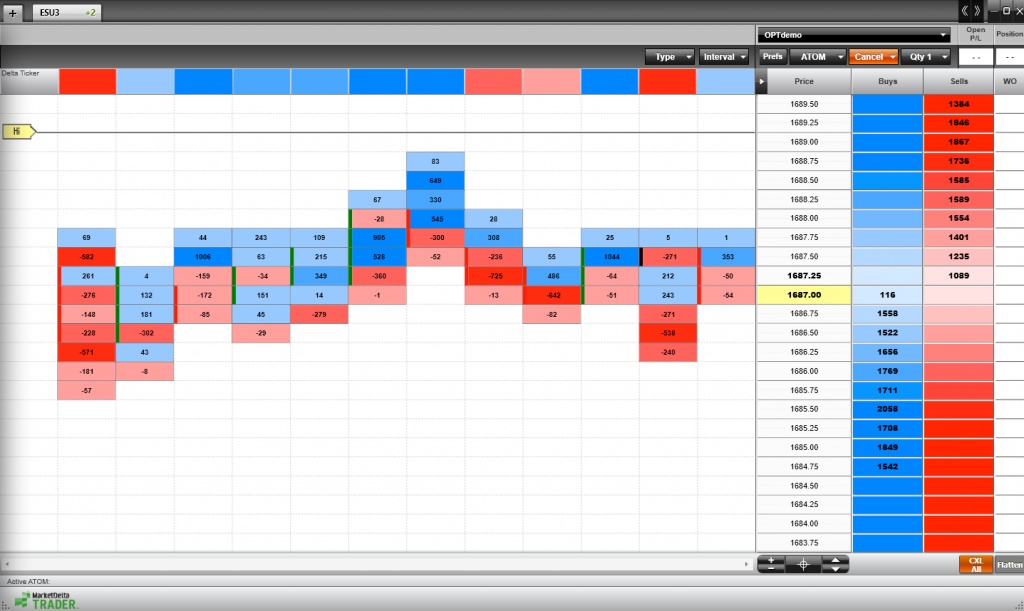

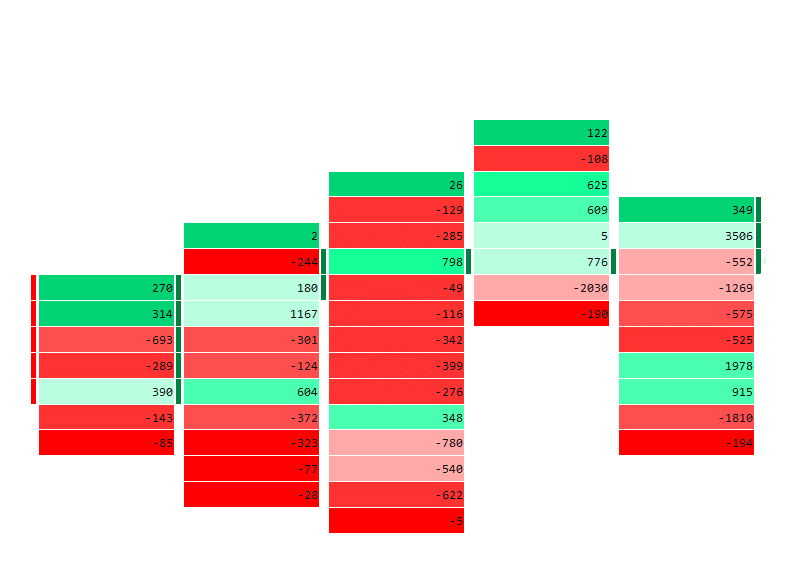

Web footprint charts provide volume information to candlestick charts. Displays the net difference at each price between volume initiated by buyers and volume initiated by sellers. Web chart visualization with settings by the delta. It allows traders to observe how orders are executed, providing a visual. Web footprint chart, volume profile, order flow, market profile.

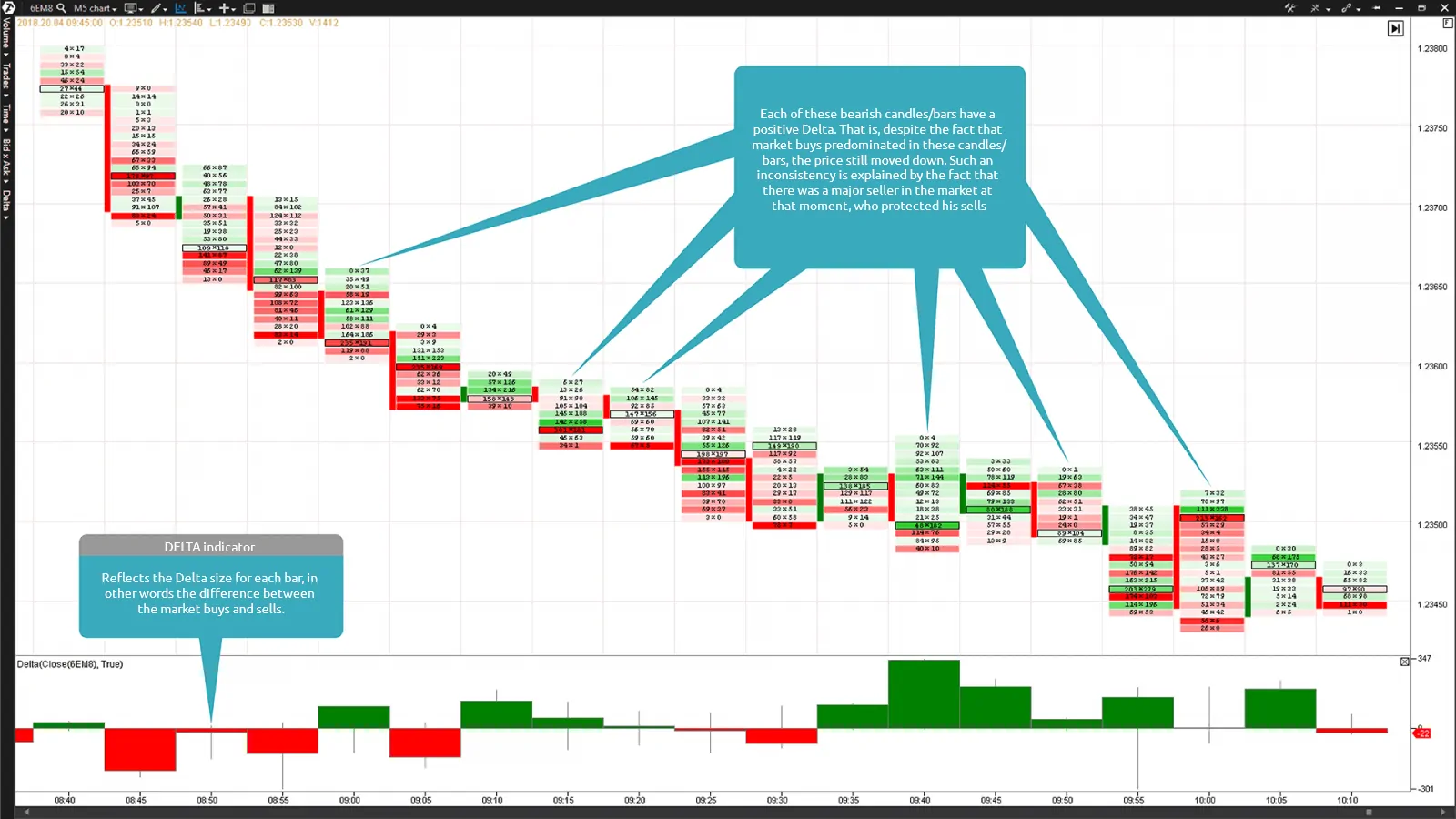

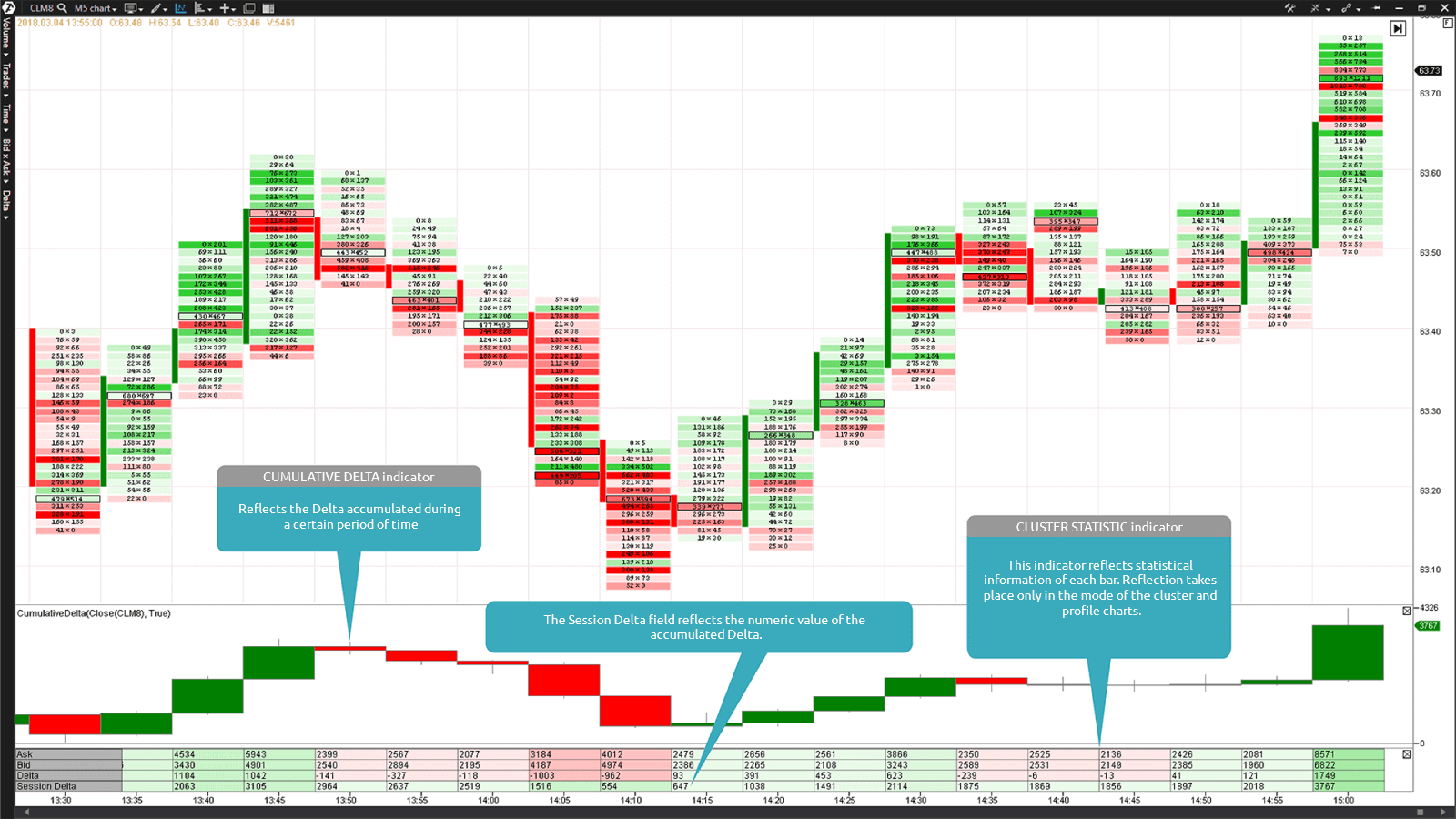

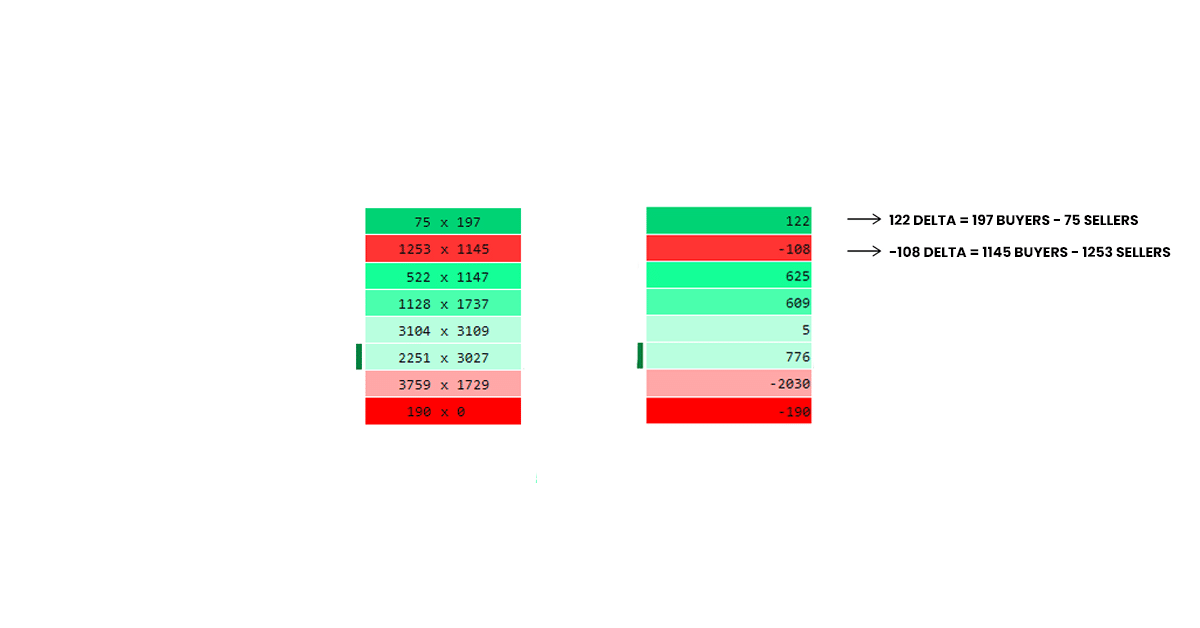

Web footprint charts are a big step forward in trading tech, started by market delta in 2003. Volume delta measure the difference between buying and selling power. Web delta is the difference between the number of market buy orders and market sell orders. The footprint chart provides increased market transparency for active traders and delivers a discrete advantage over. Delta is an indicator, but it has nothing to do with technical analysis.

This can also help with the. Strategies for trading with footprint charts include stacked imbalances,. It allows traders to observe how orders are executed, providing a visual. Displays the net difference at each price between volume initiated by buyers and volume initiated by sellers. Web footprint charts come in several flavors including bid/ask, volume profile, and delta. Web footprint charts are a big step forward in trading tech, started by market delta in 2003. Web footprint charts provides information about traded contracts in high detail. This is calculated by subtracting the volume of selling activity from the. The footprint chart provides increased market transparency for active traders and delivers a discrete advantage over. If an order is traded on the bid, it. The delta footprint helps traders. Web footprint chart, volume profile, order flow, market profile. Web the footprint chart, is a sophisticated charting tool designed to represent market order flow. In this video, we'll take a look at what the delta footprint chart is and how you. Volume delta measure the difference between buying and selling power.

Strategies For Trading With Footprint Charts Include Stacked Imbalances,.

Web learning how to read a footprint® chart. Web chart visualization with settings by the delta. Web footprint charts provides information about traded contracts in high detail. Ing your mind to understand what it means.

It Allows Traders To Observe How Orders Are Executed, Providing A Visual.

Web delta footprint charts are a great way to see absorption taking place in the order flow. This is calculated by subtracting the volume of selling activity from the. Web volume footprint is a powerful charting tool that visualizes the distribution of trading volume across several price levels for each candle on a specified timeframe, providing. Web footprint charts provide volume information to candlestick charts.

Web The Footprint Chart, Is A Sophisticated Charting Tool Designed To Represent Market Order Flow.

Web in this article, we will delve into the details of what we might call footprint trading, including the interpretation of footprint charts, identifying trading opportunities,. The footprint chart display modes in the form of delta. They often reveal large hidden orders of bid versus ask imbalances,. Displays the net difference at each price between volume initiated by buyers and volume initiated by sellers.

Web Delta Footprint Charts Show The Net Buying Or Selling Activity At Each Price Level.

It’s calculated by taking the difference of the volume that traded at the offer price and the. ' delta mode ' can help quickly identify where either market buys or market sells were more dominant over the other. This indicator specifically provides the quantity of market orders executed on each side of. The material presented here is not.